At the December 11 Council Meeting, after many months of deliberation and engagement with the community to limit the financial impact to residents as much as possible, Council approved a fiscally responsible 3.99 per cent tax increase (Town Portion) for the 2024 Budget. In total, the 3.99 per cent equates to a $96 ($8 per month) increase for the average assessed home at $709,000*.

“As with all budgets, it is very difficult to strike the balance between maintaining all services while limiting the impact to residents,” says Mayor John Taylor. “Our goal here is to be prepared for the future, and to limit the tax burden for residents today and tomorrow. To provide even better recreational opportunities for this community, we need to put more funding towards recreation capital projects that have increased in cost due to the rising cost of construction. Newmarket residents want to see more parks and trails that help contribute to the health and well-being of everyone, provide opportunities for play, and most importantly, allow us to continue to be a community that provides recreation for everyone.”

The one per cent increase for recreational capital projects will go towards the continued expansion of recreation in Newmarket, including outdoor skating, tennis and pickleball courts, parks, trails, sports pads and more. Newmarket residents continue to have a strong desire for the continued expansion of recreation opportunities in Newmarket. This is a proactive step towards planning for the future, recognizing that the cost of all capital projects have risen 30 – 40 per cent and that the Town will have less revenues from development charges as a result of Bill 23.

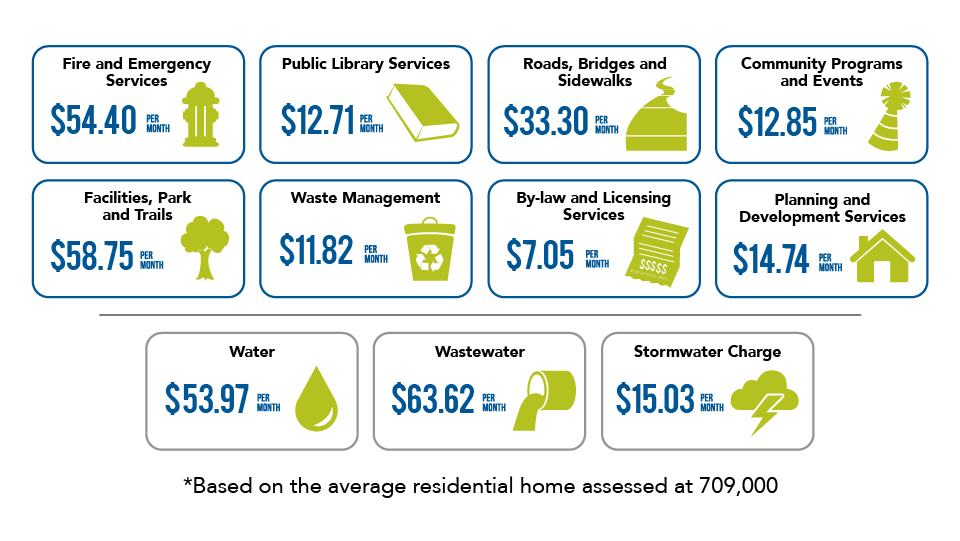

The total approved 2024 Operating Budget is $160.1 million, and the Capital Budget is $70.6 million with a combined total of $230.7 million. The 2024 Budget also includes an annual increase of $48 ($4 per month) on the water and wastewater bill and an increase of $125 ($10 per month) for the stormwater charge for the average assessed home in Newmarket*. The 2024 Budget will continue to be aligned with Newmarket’s Fiscal Strategy that ensures the Town’s future sustainability as a community.

Operating Budget

The Operating Budget ($160.1 million) will pay for the day-to-day Newmarket resident services including emergency and fire services from Central York Fire Services and the operation of the Newmarket Public Library. Property taxes account for 48 per cent of the operating budget with the remaining funded through other revenue sources (provincial grants and subsidies, user fees, sponsorships etc.)

See below for what each Newmarket service would cost monthly for the average assessed home in Newmarket:

Capital Budget

The Capital Budget funds major construction projects and repairs and upgrades to the Town’s assets and infrastructure. Capital projects are funded from dedicated and non-transferable sources. Highlights of the Capital Budget include:

Improvements to Newmarket’s Parks and Trails

Continued work on Newmarket’s iconic Mulock Park – an extraordinary park for today and tomorrow

Continued work on the Mulock Multi-Use Path which will run from Bathurst Street to Harry Walker Parkway (approx. 6km) along Mulock Drive

Improvements and upgrades to Newmarket’s facilities

Road resurfacing projects to ensure safe Newmarket roads

Continued investment into the maintenance of stormwater ponds that will reduce localized flooding and protect the environment from stormwater runoff.

Commitment to upgrades to sport pads and parkettes

For more information on the 2024 Budget, and a more detailed breakdown of the budgets, please visit newmarket.ca/2024budget

*The average assessed home by MPAC is valued at $709,000 in Newmarket. Property Assessments are conducted by MPAC (Municipal Property Assessment Corporation). All properties are valued in the state and condition as of January 1, 2016 and may not reflect the current market value.

-30-